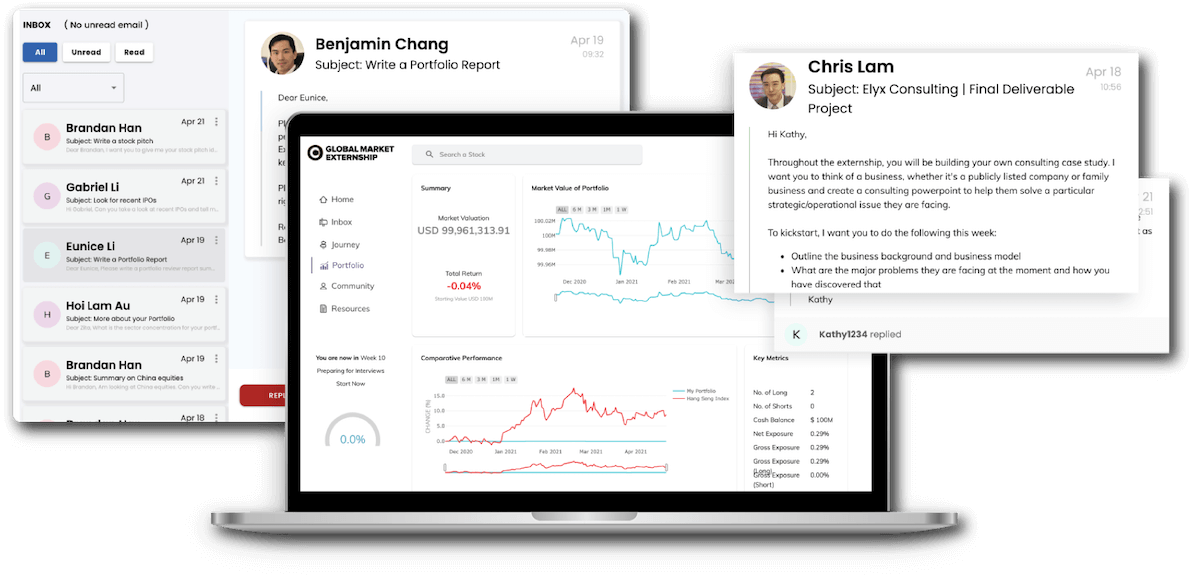

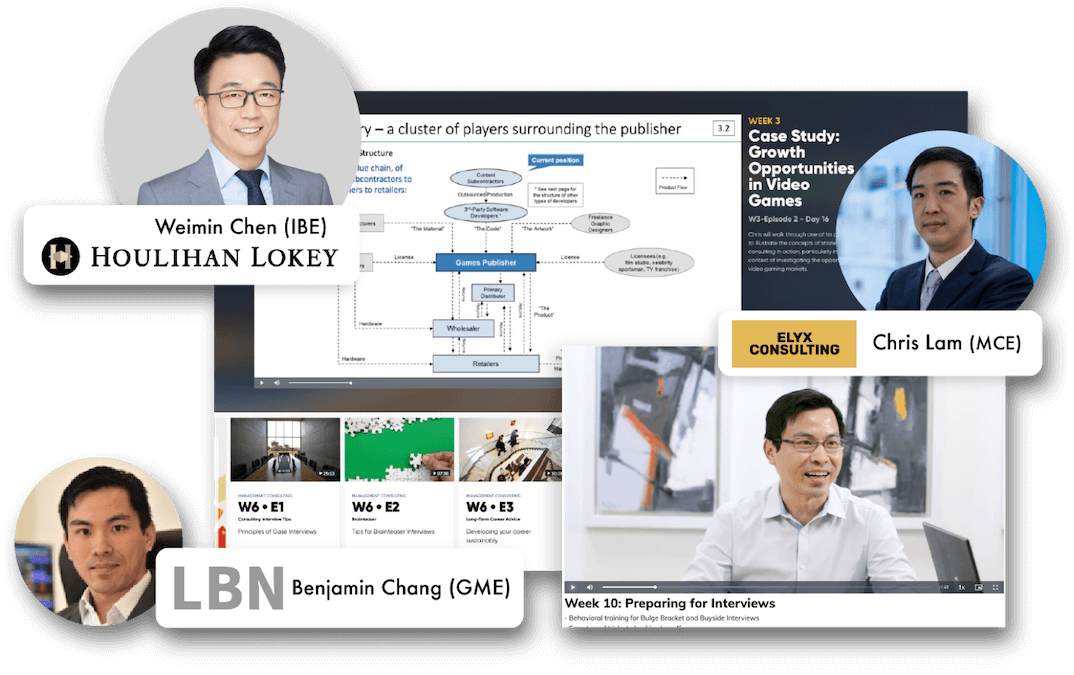

Benjamin is the CEO and Co-Founder of LBN Advisers with 10 years of experience in hedge fund and equity investing. He is hailed as The Snipper for China equities by China Investor Journal.

During the hedge fund analyst program, you will be under direct supervision and mentorship from Benjamin. You will also develop a close relationship and tap into his expertise in finance, networks and life.

Prior to founding his own hedge fund, he was an Executive Director at Goldman Sachs with 10 years of sell-side experience.

Benjamin graduated from Cornell and Johns Hopkins.